Introduction to C-PACE

Welcome to the DDA’s resource for Colorado Commercial Property Assessed Clean Energy Program (C-PACE). C-PACE is a Colorado-sponsored financing program designed to give property owners more access to renewable energy and energy efficiency improvements for building retrofits or new development projects.

This resource is intended as a detailed guide for property owners interested in applying C-PACE to their property. If you want to learn more about the basics of Colorado’s C-PACE program, please download our brochure. The following information was developed to help building owners and developers navigate their project through Colorado’s C-PACE program.

Click the links to jump to a specific section or scroll through below.

Need Help?

Become a C3E Power Partner and leverage a volunteer base to implement your clean energy project while promoting workforce development through real-world learning opportunities.

Visit coloradoc3e.org/shes-in-power/ for more information.

Properties must be owned by an individual, a business, or a non-profit and must be listed on the county property tax roll. The C-PACE project must also either represent a retrofit or new construction of a commercial property. For the purposes of C-PACE, commercial properties also include multi-family residential properties with five units or more.

Building Envelope

- Windows and doors

- Insulation

- Roof replacement

Heating, Ventilation, and Air Conditioning (HVAC)

- Equipment upgrades

- Automatic controls systems

Lighting

- Fixture replacement

- Automatic control system

- Daylighting control measures

Water Efficiency

- Indoor fixture upgrades

- Irrigation controllers

Electric Vehicle (EV) Charging Equipment

Colorado C-PACE financing can also support renewable energy projects that produce on-site energy to reduce the building’s utility-supplied electricity or natural gas use. Examples of these projects include:

Solar photovoltaics (PV)

Biomass

Solar thermal

Fuel Cells

Small-scale wind

Waste-to-power systems

Low-impact hydroelectric

C-PACE acknowledges that there may also be unique projects or improvements that support the goals of the program. Custom improvements not included on the list of eligible projects can be approved by the New Energy Improvement District, which provides government oversight of C-PACE. Contact C-PACE staff for more information about this approval process.

C-PACE Program Director

Tracy Phillips

(720) 933-8143

tphillips@copace.com

Expenses associated with energy efficiency and renewable energy projects that are related to the project may also be included in the C-PACE financing package. Eligibility requirements to determine if expenses can be included in the C-PACE financing package are determined by expense category as outlined below.

– Eligible expenses: Any project costs that directly relate to the energy efficiency or renewable energy improvements being installed. This includes costs for services such as:

- Energy audits

- Renewable energy feasibility studies

- Engineering design

- Construction and installation

- Prepaid operation and maintenance costs

- Lender fees

- Permit fees

- Project developer services

- C-PACE program fees

All eligible expenses can be financed as part of the overall project costs.

– Ineligible expenses: Project expenses not considered an eligible expense can still be financed if they don’t represent more than 30% of the total project cost. Any improvements that are easily removed from the property or improvements that are not yet commercially available are considered “ineligible.”

Ineligible measures that are approved for financing with the rest of the project are often related in some way to the eligible improvements being installed. Examples of ineligible expenses that have been financed include:

- Roof upgrade or carport structure associated with a solar PV installation

- Ductwork replacement associated with a new rooftop unit

- Asbestos abatement associated with a boiler retrofit

- Electrical upgrades or transformer replacements associated with a new PV solar installation or lighting retrofit

If you have questions about expenses related to your C-PACE financed project, contact C-PACE.

C-PACE Program Director

Tracy Phillips

(720) 933-8143

tphillips@copace.com

C-PACE financing is provided by private lenders at competitive rates and, as such, each project undergoes a unique underwriting process specific to the capital provider. However, there are some underwriting standards required by the Colorado C-PACE program that apply to all projects. These standards are in place to ensure that each project is financially a good fit for the C-PACE financing structure and to provide some risk mitigation for financing institutions. These underwriting standards are also a good indication of how good a fit your project is for C-PACE financing.

Project Size:

C-PACE project financing typically ranges from $50,000 to $3 million. Projects outside this range can be discussed directly with the Colorado C-PACE office for eligibility considerations.

Property Financial Health:

A property with a lower debt to value ratio is typically more favorable in the eyes of a lender and is one of the primary indicators that will be considered by C-PACE. Lenders will also review property tax payments to verify that the property owner has been and is current on payments. There must also be no involuntary liens, defaults, or judgments applicable to the property, and the owner may not be currently or previously in bankruptcy.

Project Financials:

Capital providers often prepare an analysis of the cash flow generated by the property to help determine the ability of the property owner to make the C-PACE special assessment payments. C-PACE contractors can help determine the costs and cost savings, associated with the proposed project, that would be included in the financial analysis. This analysis will often include a debt service coverage ratio (DSCR) calculation – lenders typically look for a ratio of 1.25 or higher. Other metrics may be included in the analysis as well, to develop a clear picture of the financial health of the business.

If you have questions or concerns about any of these financial indicators, contact C-PACE.

C-PACE Program Director

Tracy Phillips

(720) 933-8143

tphillips@copace.com

Colorado C-PACE requires technical vetting for every project, to ensure that each project will deliver the desired energy and cost savings upon completion. Technical vetting requirements are listed by project type below.

Energy or Water Efficiency Projects: An energy audit is performed by a C-PACE project developer to provide quantified energy, water, and cost savings potential for the project. It includes baseline consumption, savings projections, documentation for utility rebates or other incentives, and a draft construction schedule.

This requirement is waived for single-measure projects involving like-for-like equipment replacements in which the focus of the analysis can be performed solely on the equipment or systems involved in the retrofit (a lighting retrofit, for example), rather than a comprehensive audit of the entire building and its systems.

Renewable Energy: The C-PACE project developer completes a feasibility study to examine the energy production potential, estimated cost savings, and installation costs to determine the potential return on investment for the project. The feasibility study also encompasses system analysis, schematics of the system design, documentation for rebates and other incentives, and unit pricing for the system. Your contractor may use the program’s online Energy Efficient Contractor Tool (EPIC) or the Renewable Energy Contractor Tool (PACEworx Estimator) to streamline the feasibility study.

The C-PACE staff will review these analyses and work with the project developer and/or C-PACE contractors to help provide the best project plan possible. These analyses can give owners and lenders confidence in the project, thanks to this third-party validation, as well as help optimize the appropriate scope of the improvements to be installed.

Project Highlight

Forney Museum

Project type: Energy efficiency Total project cost: $63,073

Building type: Nonprofit Percent financed: 100%

Building size: 146,217 sq. ft. Asset value increase: $176,312

Finance: Terms: 10 years Lifetime energy savings: $229,206

“This C-PACE project will allow the museum to save greatly on our energy costs, freeing up funds for other worthwhile projects such as artifact preservation, educational programming, and volunteer opportunities.”

—Christof Kheim, director of The Forney Museum of Transportation

C-PACE asks that at least one of the contractors working on the project go through a brief registration process and attend one half-day C-PACE contractor training. This process helps familiarize contractors with the program and ensures that they can smoothly navigate the process and analysis requirements. There are numerous Northern Colorado contractors and developers registered with the C-PACE program. A list can be found here.

Alternatively, registration can be completed by your contractor or developer of choice (here).

Obtaining a financing partner for a C-PACE project is a crucial step in the process. Here are a few things to keep in mind when engaging lenders:

- Mortgage holders are required to subordinate the position of their lien for the C-PACE special assessment to be placed on the property. It can be easier to secure mortgage holder approval if the same financial institution is also the capital provider for the project.

- Lenders look more favorably on properties or owners with an established financial record. Property owners who have already successfully paid down a good portion of a mortgage, or a property that has had financial success over multiple owners, often appear to be more favorable to lenders.

- Many lenders prefer to fund projects for buildings with a debt-to-value ratio of less than 80%.

C-PACE staff has experience with assuring lenders about the financial merits of C-PACE projects. If your capital provider or mortgage holder seems apprehensive, be sure to get C-PACE staff involved in the process.

C-PACE Program Director

Tracy Phillips

(720) 933-8143

tphillips@copace.com

C-PACE has also developed materials and forms for communicating with lenders. These materials can help clarify the C-PACE process. They can be found here under program financing documents.

Keys to Success

Begin engaging potential lenders early in the project process – even before complete project details are developed.

Approach the current mortgage holder first. It is often easier for many lenders to justify subordinating their lien position if they are also going to be the capital provider for the project.

Scope the improvements for the property to maintain a debt-to-value ratio below 80%.

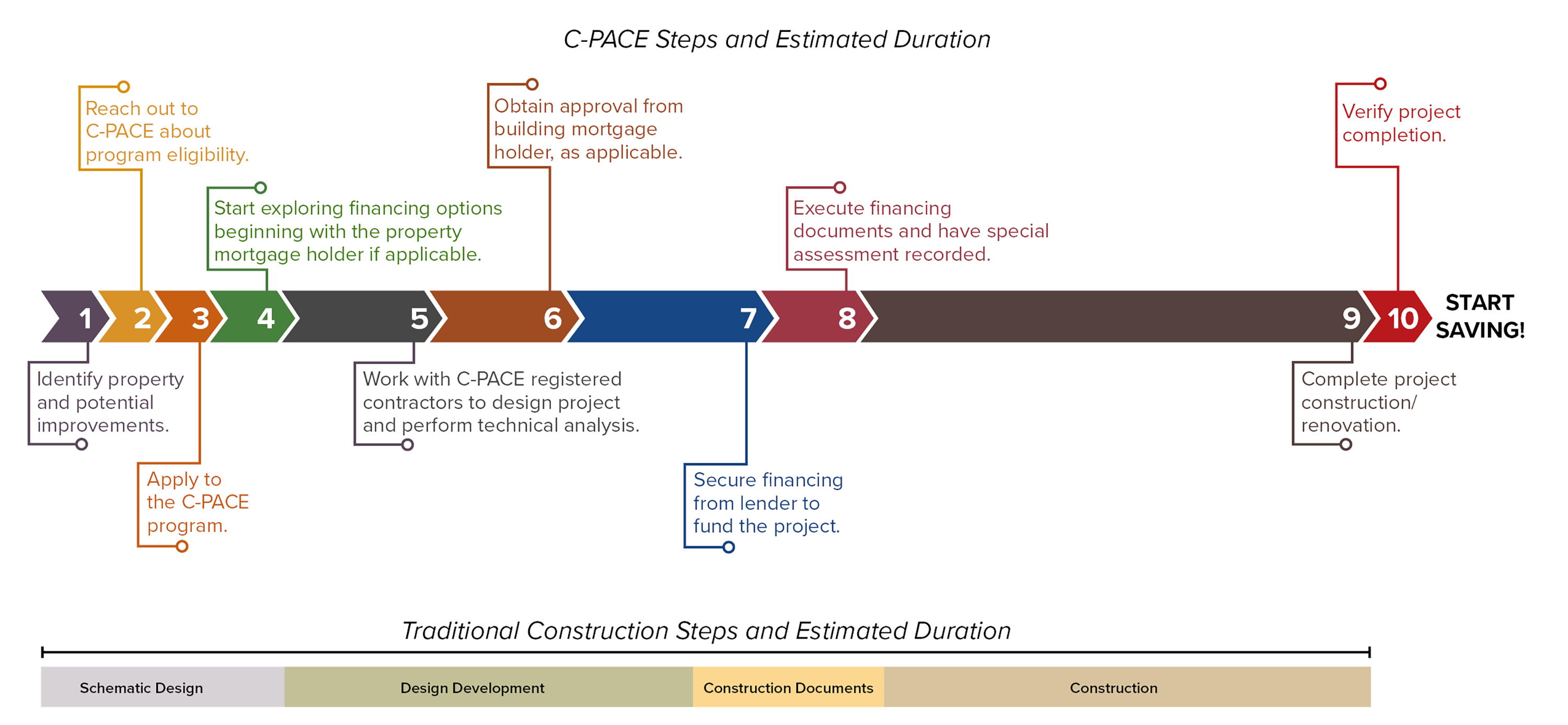

The C-PACE process involves multiple and often iterative steps with various project stakeholders including C-PACE, contractors, mortgage holders and lenders. It does take time and planning, so it is important to begin the process early and to reach out for support when needed.

Integrating C-PACE with the traditional construction timeline is important for the smooth completion of your project. The timeline below shows the C-PACE steps in parallel with the phases of the traditional construction process.

#1

Project Identification

Determine a specific property and potential efficiency or renewable energy improvements that might be implemented. Consider whether the property and set of improvements might be a good candidate for C-PACE financing.

#2

Contact C-PACE

Reach out to the Colorado C-PACE program to begin the project prescreening process. This prescreening process involves a basic review, by C-PACE, of the public records available for the property. The goal of this review is to determine the eligibility status of the property for the C-PACE program. To initiate this process, building owners only need to submit a request that includes the property address and 12 months of recent utility data (if available) to C-PACE program staff. Project prescreening is provided at no cost.

#3

Apply

Submit a Pre-Qualification Submission form to C-PACE staff to apply to the program. This submission is an official request to participate in C-PACE and includes details about the property and the high-level vision and scope of the project. Detailed analysis or financials are not yet required. Pre-Qualification is used to confirm program eligibility. Once eligibility is confirmed, a meeting will be scheduled by C-PACE staff to kick off the project.

#4

Explore Financing

At this stage in the project, it makes sense to begin engaging financial institutions. Start with banks or lenders, including the existing mortgage holder, that have an existing relationship with the building owner. When engaging lenders, provide high-level project scope and inquire about their general interest.

#5

Develop Project

The project development phase includes much of the design and technical analysis, and proceeds as financing opportunities develop. During this part of a project, building owners reach out to and work with C-PACE project developers and registered contractors to determine the optimal scope of work and cost for the project. Contractors and developers will perform the required technical studies and may model multiple scenarios. Upon development of the optimal project scenario, C-PACE staff will review the scope of work, analysis, and supporting documentation, perform a quality assurance review, and develop an economics analysis report to determine the project’s economics and approved program financing thresholds. Include these project details in ongoing conversations with potential capital providers as they are developed. See Technical Project Requirements for more information on required technical studies.

#6

Mortgage Holder Approval

Written permission must be given by the existing mortgage holder of the property for the C-PACE transaction to move forward. C-PACE project developers will often lead these conversations. C-PACE staff members are also available to assist in discussions with the mortgage holder about the financial merits of the project and to assist with the development of consent documentation. This process can happen in parallel with the development of the project.

#7

Secure Project Financing

Once a preferred lender has been selected, C-PACE staff will work with the lender and building owner to facilitate the analysis and documentation necessary for the underwriting process. Ultimately, the building owner will work with their preferred lender to execute the program’s Assessment and Financing Agreement. This document outlines the details of the financial agreement between the property owner and the capital provider.

#8

Special Purpose Assessment & Lien

A Preliminary Assessing Resolution is prepared by the New Energy Improvement District at the Colorado Energy Office, the C-PACE oversight body, upon mortgage holder consent and finance amount determination. This resolution results in a 30-day comment period in which all lien holders are notified of the progression of the C-PACE assessment process. At the completion of the 30-day comment period, a hearing is held on the Final Assessing Resolution. This resolution finalizes and records the C-PACE lien with the county. This public hearing is held with the property owner, capital provider, and other interested parties. Once all documents have been received by C-PACE and closing conditions have been met, the lien is recorded in the County property records. Upon recording of the lien, project funds are released by the capital provider.

#9

Complete Construction

In this phase of the project, funds are dispersed by the funding partner to the building owner or developer and the project work is completed by the approved contractor.

#10

Verify Project

C-PACE staff will perform a site visit upon construction completion and will prepare a project verification report documenting satisfactory installation of the energy efficiency or renewable energy equipment.

#11

Servicing/Repayment

After the completion of the project, C-PACE financing is repaid by the property owner through the special purpose assessment on the property tax bill. This repayment will proceed according to the terms set forth in the Assessment and Financing Agreement and may be transferred to subsequent building owners if the property is sold during the financing period.

Colorado’s C-PACE program is designed to be completely self-sustained. As such, there is a fee placed on each project to fund the services provided by the program. This fee is only applied to successfully-financed projects and is equal to 2.5% of the total financed amount or $50,000 maximum. This fee is typically included in the financed amount.